Simple Interest Calculator

A Simple Interest Calculator is a financial tool designed to calculate the interest earned or paid on a principal amount over a specified period. This calculator is invaluable for determining the interest associated with a loan or investment, aiding individuals in making informed financial decisions. For instance, when considering a loan, the calculator can compute the total interest payable, enabling better evaluation of borrowing costs. Similarly, for investments such as fixed deposits or other financial instruments offering simple interest, the calculator provides an estimate of the total interest earned, facilitating more effective financial planning.

- Principal Amount

- Total Interest

- Invested Amount

- ₹10000

- Total Interest

- ₹11589

- Maturity Value

- ₹21589

Comprehensive Guide to Simple Interest Calculator

A Simple Interest Calculator is a tool used to calculate the interest earned or payable on a principal amount at a fixed interest rate for a specified period. Simple interest is calculated based on the initial principal amount and does not take into account any interest that accumulates on previously earned interest. This guide covers the components, usage, benefits, and practical examples of a Simple Interest Calculator.

Components of a Simple Interest Calculator

- Principal Amount: The initial amount of money invested or borrowed.

- Interest Rate: The annual rate at which interest is applied to the principal amount, usually expressed as a percentage.

- Time Period: The duration for which the principal amount is invested or borrowed, typically expressed in years.

How to Use a Simple Interest Calculator

- Input Principal Amount: Enter the initial amount of money invested or borrowed.

- Enter Interest Rate: Input the annual interest rate as a percentage.

- Enter Time Period: Input the duration for which the principal amount is invested or borrowed, typically in years.

- Calculate: The calculator will compute the simple interest based on the inputs.

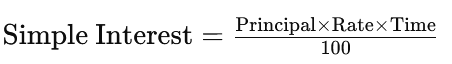

Formula for Calculating Simple Interest

The formula for calculating simple interest is:

Where:

- Simple Interest is the interest earned or payable.

- Principal is the initial amount invested or borrowed.

- Rate is the annual interest rate (as a percentage).

- Time is the duration for which the principal amount is invested or borrowed (in years).

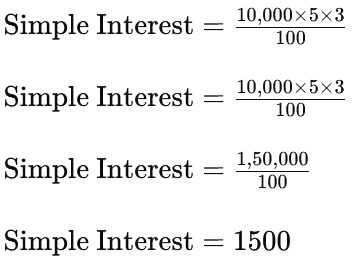

Example Calculation

Let's calculate the simple interest earned on a principal amount with the following details:

- Principal Amount: ₹10,000

- Interest Rate: 5%

- Time Period: 3 years

Using the formula:

So, the simple interest earned on the principal amount will be ₹1500 approximately.

Conclusion

A Simple Interest Calculator is a valuable tool for both investors and borrowers to calculate interest amounts accurately and efficiently. By understanding the components and using the calculator effectively, users can make informed decisions about their financial activities and plan their investments or loans effectively.