Fixed Deposit Returns Calculator

A Fixed Deposit (FD) Calculator can significantly enhance your investment strategy by accurately calculating the maturity amount and helping you select the optimal term and compounding period for your fixed deposits. Often, investors overlook this crucial initial step and end up with lower returns on investment (ROI) due to the complexity and potential inaccuracies of manual calculations. The solution is to use an FD calculator.

Banks and non-banking financial institutions (NBFCs) accept funds for a fixed duration, offering an agreed-upon interest rate, which can be either fixed or variable. Investors can also choose the frequency of compounding. Both the principal and the tenure (with a minimum of 7 days) are adjustable.

An online FD calculator assists in making informed decisions by estimating the earnings based on the deposit amount, interest rate, and tenure. This tool simplifies financial planning by providing precise predictions of the maturity amount, ensuring you receive both the deposited sum and the accrued interest at maturity.

- Total Interest

- Investment Amount

- Principal Amount

- ₹10000

- Total Interest

- ₹11589

- Maturity Value

- ₹21589

Comprehensive Guide to Fixed Deposit Returns Calculator

Fixed Deposits (FDs) are a popular investment option due to their safety and assured returns. An FD returns calculator helps investors determine the interest earnings and the total maturity amount from an FD investment. This guide will walk you through the components, usage, and benefits of an FD returns calculator.

Components of an FD Returns Calculator

- Principal Amount: The initial sum of money invested.

- Interest Rate: The annual interest rate provided by the bank or financial institution.

- Tenure: The duration for which the money is invested, usually ranging from a few months to several years.

- Compounding Frequency: How often the interest is compounded (monthly, quarterly, half-yearly, or annually).

How to Use an FD Returns Calculator

- Input Principal Amount: Enter the amount you wish to invest.

- Enter Interest Rate: Input the annual interest rate offered by the financial institution.

- Select Tenure: Choose the duration of the investment.

- Choose Compounding Frequency: Select how frequently the interest should be compounded.

- Calculate: The calculator will compute the maturity amount and the total interest earned.

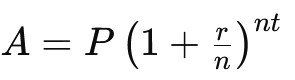

Formula for Calculating FD Returns

The maturity amount of an FD can be calculated using the formula:

Where:

- M = Maturity amount

- P = Principal amount

- r = Annual interest rate (decimal)

- n = Number of times interest is compounded per year

- t = Tenure in years

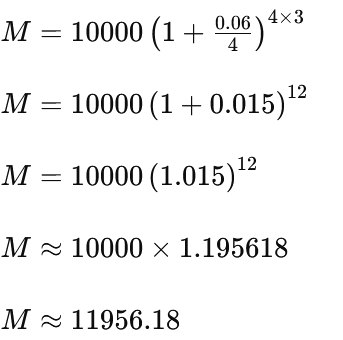

Example Calculation

Let's calculate the returns on a fixed deposit with the following details:

- Principal Amount: ₹10,000

- Annual Interest Rate: 6%

- Tenure: 3 years

- Compounding Frequency: Quarterly

Using the formula:

Total interest earned = ₹11956.18 - ₹10000 = ₹1956 approximately.

Conclusion

An FD returns calculator is an essential tool for investors looking to make informed decisions about their fixed deposit investments. By understanding the components and using the calculator effectively, investors can maximize their returns and achieve their financial goals.