EMI Calculator

Whether you're considering borrowing money for a home, vehicle, or education, it's crucial to ensure you are not overextending your finances. An EMI Calculator is an indispensable tool for determining your exact monthly Equated Monthly Installment (EMI) payments. This user-friendly and convenient tool helps you calculate how much you can afford to allocate towards your EMI payments. Additionally, the calculator allows you to compare different loan options and assess the impact of varying interest rates on your EMI payments. By providing an approximate monthly payment, the EMI Calculator enables you to make informed decisions and determine if your dream purchase is financially feasible.

- ₹ 5 K

- ₹ 10 L

- 3 M

- 60 M

- 5 %

- 30 %

- Interest Amount

- Principal Amount

- Monthly EMI

- Principal Amount

- Interest Amount

- Total Amount to Pay

Comprehensive Guide to EMI Calculator

An Equated Monthly Installment (EMI) calculator is a useful tool for borrowers to determine their monthly loan payments. It simplifies the process of planning loan repayments by providing an accurate estimate of the monthly installments based on the loan amount, interest rate, and tenure. This guide will cover the components, usage, benefits, and practical examples of an EMI calculator.

Components of an EMI Calculator

- Loan Amount (Principal): The total amount of money borrowed.

- Interest Rate: The annual interest rate charged by the lender.

- Loan Tenure: The duration of the loan, typically expressed in months or years.

- EMI: The fixed monthly payment amount.

How to Use an EMI Calculator

- Input Loan Amount: Enter the total loan amount you wish to borrow.

- Enter Interest Rate: Input the annual interest rate offered by the lender.

- Select Loan Tenure: Choose the loan duration in months or years.

- Calculate: The calculator will compute the EMI amount based on the inputs.

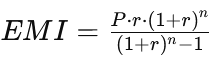

Formula for Calculating EMI

The EMI for a loan can be calculated using the formula:

Where:

- EMI = Equated Monthly Installment

- P = Loan amount (Principal)

- r = Monthly interest rate (annual interest rate divided by 12 and converted to decimal)

- n = Loan tenure in months

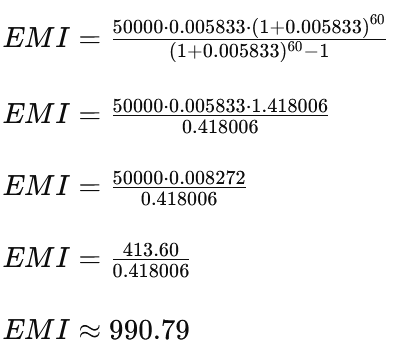

Example Calculation

Let's calculate the EMI for a loan with the following details:

- Loan Amount: ₹50,000

- Annual Interest Rate: 7%

- Loan Tenure: 5 years

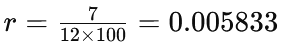

First, convert the annual interest rate to a monthly rate:

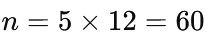

Convert the loan tenure from years to months:

Using the formula:

So, the monthly EMI will be approximately ₹990.

Conclusion

An EMI calculator is an essential tool for anyone planning to take a loan. By understanding the components and using the calculator effectively, borrowers can make informed decisions about their loans and manage their finances better.