Compound Interest Calculator

In the realm of investment, compounding is synonymous with wealth accumulation over time. Compound interest refers to the process of earning interest on both the initial principal and the previously accrued interest. This mechanism allows the investment to grow exponentially, as interest is continually added to the principal, resulting in an ever-increasing asset value throughout the investment period. Utilizing a compound interest calculator can be an effective tool for optimal investment planning.

- Principal Amount

- Total Interest

- Principal Amount

- ₹10000

- Total Interest

- ₹11589

- Maturity Value

- ₹21589

Comprehensive Guide to Compound Interest Calculator

Comprehensive Guide to Compound Interest Calculator Compound interest is the interest calculated on the initial principal and also on the accumulated interest of previous periods. This guide will explain how to use a compound interest calculator, the underlying formula, and provide examples to ensure clarity.

Understanding Compound Interest

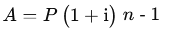

Compound interest grows at a faster rate than simple interest, which is only calculated on the principal amount. The formula for compound interest is:

Where:

- A = the future value of the investment/loan, including interest

- P = the principal investment amount (initial deposit or loan amount)

- r = annual interest rate (decimal)

- n = number of times that interest is compounded per year

- t = the time the money is invested or borrowed for, in years

Components of a Compound Interest Calculator

A typical compound interest calculator will include fields for the following inputs:

- Principal (P): The initial sum of money invested or loaned.

- Annual Interest Rate (r): The percentage of interest per year.

- Compounding Frequency (n): How often the interest is compounded (e.g., annually, semi-annually, quarterly, monthly, daily).

- Time (t): The number of years the money is invested or borrowed.

Conclusion

A compound interest calculator is a powerful tool for planning investments and understanding loan costs. By mastering its use, you can make informed financial decisions and maximize your returns. Remember to consider the frequency of compounding and the effect of regular contributions to fully appreciate the power of compound interest.