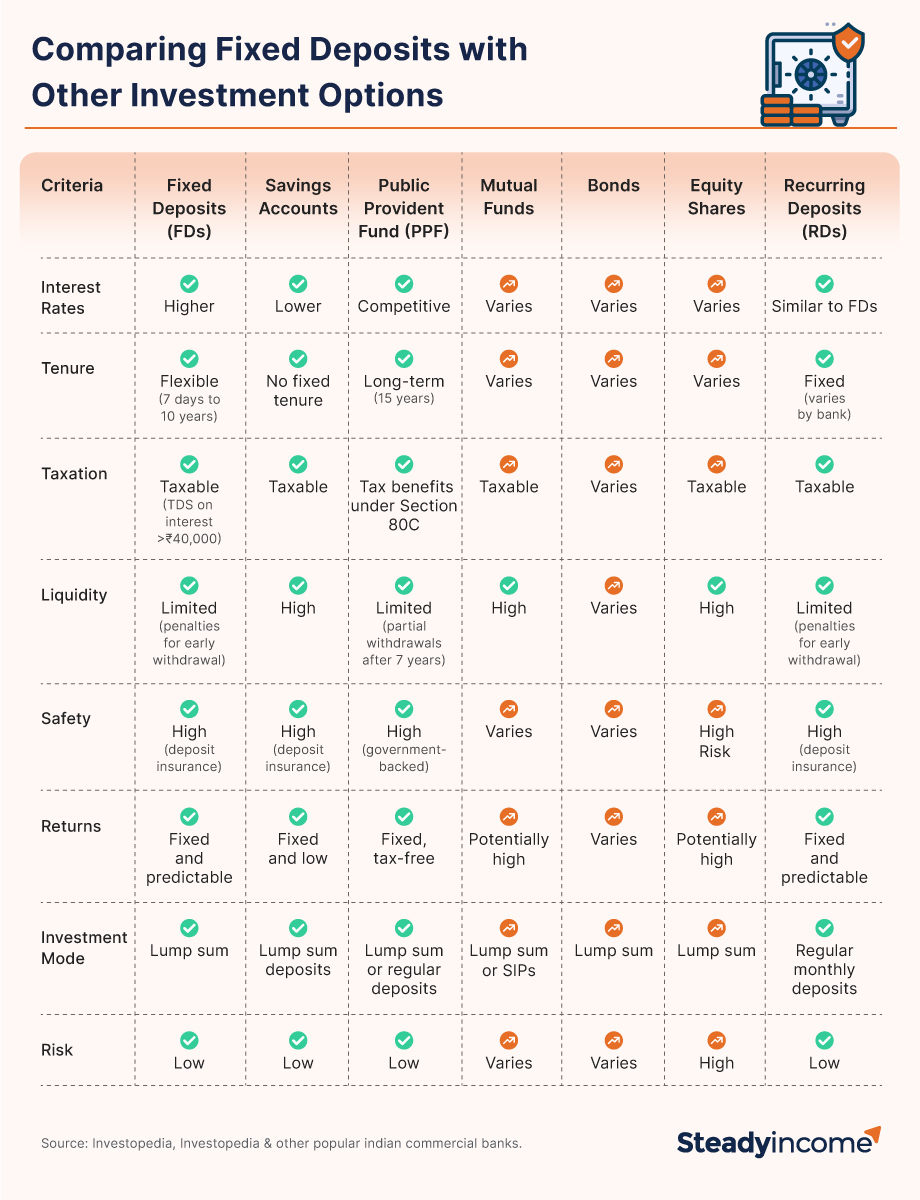

Comparing Fixed Deposits with Other Investment Options: A Comprehensive Guide for Indian Investors

Fixed Deposits (FDs) are a popular investment choice in India, known for their safety, fixed returns, and simplicity. However, they are just one of many investment options available. Understanding how FDs stack up against other investment avenues can help you make informed decisions aligned with your financial goals. This article compares fixed deposits with various other investment options to provide a clear picture of their advantages and limitations.

1. Fixed Deposits vs. Savings Accounts

Fixed Deposits (FDs):

- Interest Rates: Generally higher than savings accounts, providing a fixed return over the deposit tenure.

- Tenure: Ranges from a few months to several years.

- Liquidity: Less liquid; premature withdrawal attracts penalties.

- Safety: High, with deposit insurance up to Rs. 5 lakh per depositor.

Savings Accounts:

- Interest Rates: Lower than FDs, with interest compounded quarterly or monthly.

- Tenure: No fixed tenure; funds are available on demand.

- Liquidity: Highly liquid; funds can be withdrawn anytime.

- Safety: Also covered by deposit insurance up to Rs. 5 lakh per depositor.

Comparison: FDs offer higher returns compared to savings accounts but at the cost of liquidity. Savings accounts provide easy access to funds but with lower interest rates.

2. Fixed Deposits vs. Public Provident Fund (PPF)

Fixed Deposits (FDs):

- Interest Rates: Fixed and generally higher than PPF rates.

- Tenure: Flexible; typically from 7 days to 10 years.

- Taxation: Interest earned is taxable, with TDS applicable on amounts exceeding Rs. 40,000 annually.

- Withdrawal: Premature withdrawal is penalized.

Public Provident Fund (PPF):

- Interest Rates: Government-backed and generally competitive, with quarterly compounding.

- Tenure: Long-term, with a lock-in period of 15 years.

- Taxation: Tax benefits under Section 80C, with interest and maturity amount exempt from tax.

- Withdrawal: Partial withdrawals allowed after the 7th year, with the option to extend the account.

Comparison: PPF offers tax benefits and long-term security, while FDs provide higher returns over shorter periods but without tax benefits.

3. Fixed Deposits vs. Mutual Funds

Fixed Deposits (FDs):

- Risk: Low; principal and interest are guaranteed.

- Returns: Fixed and predictable.

- Liquidity: Limited; early withdrawal incurs penalties.

- Suitability: Ideal for risk-averse investors looking for stable returns.

Mutual Funds:

- Risk: Varies; depends on the type of mutual fund (equity, debt, hybrid).

- Returns: Not guaranteed; potential for higher returns based on market performance.

- Liquidity: Generally high; units can be redeemed at the current NAV.

- Suitability: Suitable for investors seeking higher returns and willing to take on market risk.

Comparison: Mutual funds offer the potential for higher returns and greater liquidity but come with market risk, unlike the guaranteed returns of FDs.

4. Fixed Deposits vs. Bonds

Fixed Deposits (FDs):

- Interest Rates: Fixed and guaranteed by the bank or institution.

- Safety: High; covered under deposit insurance.

- Liquidity: Limited; early withdrawal penalties.

Bonds:

- Interest Rates: Vary; can be fixed or floating, depending on the bond type.

- Safety: Depends on the issuer; government bonds are safer than corporate bonds.

- Liquidity: Varies; government bonds are usually more liquid than corporate bonds.

Comparison: Bonds can offer higher yields and a variety of options compared to FDs. However, FDs provide guaranteed returns and higher safety.

5. Fixed Deposits vs. Equity Shares

Fixed Deposits (FDs):

- Risk: Low; principal and interest are guaranteed.

- Returns: Fixed and predictable.

- Liquidity: Limited; penalties for early withdrawal.

- Suitability: Suitable for conservative investors.

Equity Shares:

- Risk: High; subject to market volatility.

- Returns: Potential for high returns, but not guaranteed.

- Liquidity: High; can be bought or sold on stock exchanges.

- Suitability: Ideal for investors with a high risk tolerance and a long-term investment horizon.

Comparison: Equity shares offer higher return potential and liquidity but come with significant risk. FDs are more suited for conservative investors seeking stability.

6. Fixed Deposits vs. Recurring Deposits (RDs)

Fixed Deposits (FDs):

- Investment: Lump-sum deposit made at the beginning.

- Interest Rates: Fixed and higher for longer tenures.

- Liquidity: Limited; penalties for early withdrawal.

Recurring Deposits (RDs):

- Investment: Regular monthly deposits.

- Interest Rates: Similar to FDs; fixed.

- Liquidity: Less liquid; premature withdrawals incur penalties.

Comparison: RDs are ideal for investors who prefer regular, small investments and want to benefit from compounding, while FDs are better for lump-sum investments seeking higher interest.

Conclusion

Choosing the right investment option requires a clear understanding of your financial goals, risk tolerance, and investment horizon. Fixed Deposits offer safety and guaranteed returns, making them suitable for conservative investors. However, other options like PPF, mutual funds, and equity shares might provide higher returns or tax benefits, depending on your individual needs.

By comparing FDs with other investment avenues, you can diversify your portfolio and make informed choices that align with your financial objectives. Each investment type has its own set of advantages and limitations, so a balanced approach considering your risk appetite and goals will help you achieve financial stability and growth.